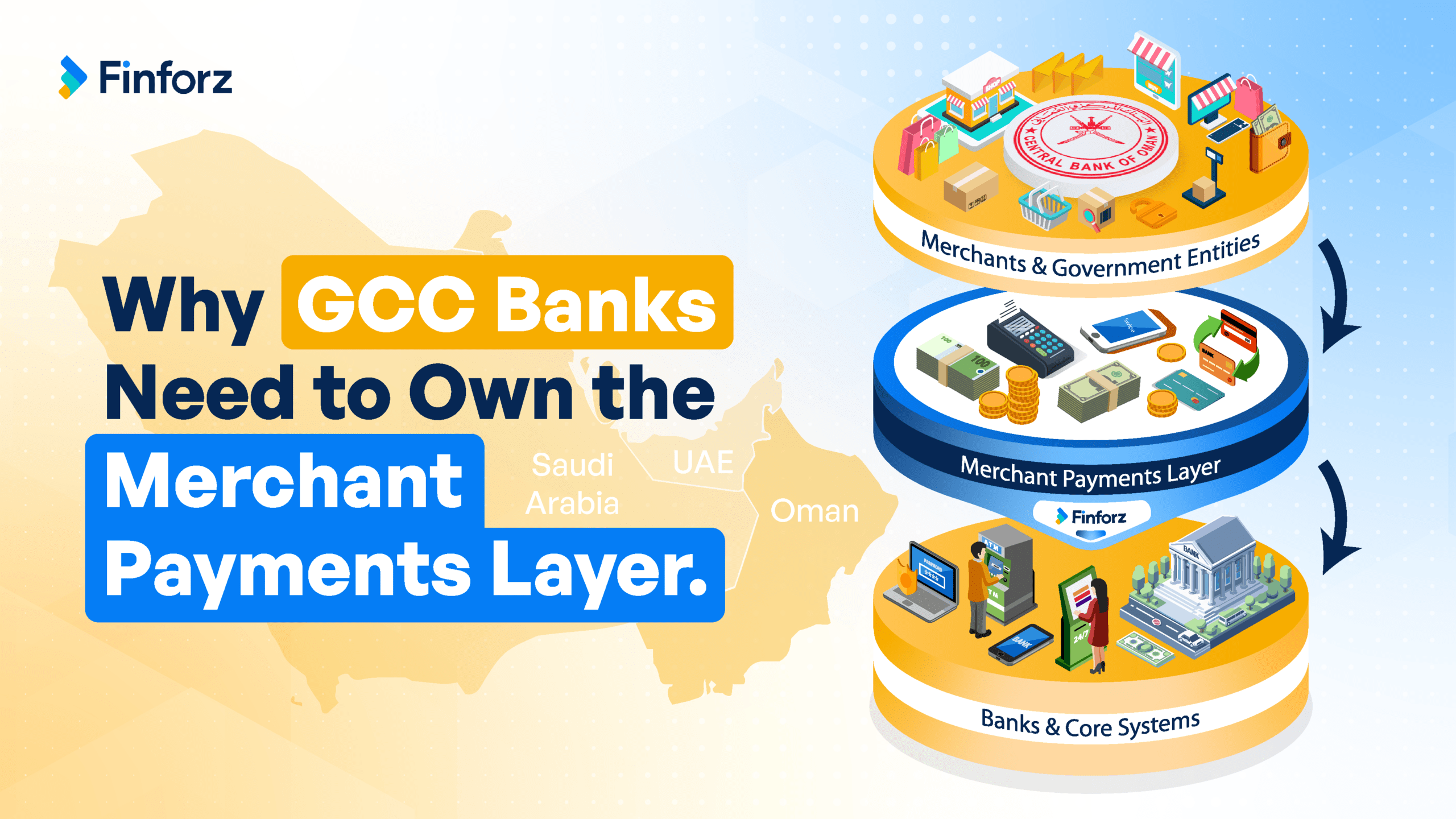

Why GCC Banks Need to Own the Merchant Payments Layer (Not Outsource It)

For years, banks across the GCC have played a supporting role in merchant payments providing settlement accounts, compliance oversight, and sponsor banking.

But while banks carried the balance sheets and regulatory responsibility, the value quietly moved elsewhere.

Today, fintechs and payment service providers own the merchant interfaces, the data, and the transaction growth, while banks remain in the background.

The Current Reality of Merchant Payments in the GCC

Across Oman, UAE, and Saudi Arabia, merchant payments today are characterised by:

- Multiple PSPs per merchant (cards, wallets, QR, bank transfers)

- Fragmented payment rails running in parallel

- Manual reconciliation across PSP dashboards, POS reports, and bank statements

- Slow merchant onboarding, often managed via emails, spreadsheets, and offline approvals

This is not theoretical.

According to SAMA (Saudi Central Bank), electronic payments already account for ~79% of consumer retail transactions in Saudi Arabia, driven by Vision 2030 cashless targets.

Yet reconciliation and reporting across schemes and rails remain fragmented especially for SMEs and government-linked entities.

In the UAE, data published by industry and regulator-backed reports indicate that ~46% of the population actively uses digital wallets, supported by multiple closed-loop and national payment schemes.

Despite this adoption, many SMEs still rely on manual reconciliation due to lack of unified payment orchestration.

In Oman, the rapid uptake of OmanNet and MPCSS QR under the Central Bank of Oman’s National Payment Systems (NPS) framework has expanded digital acceptance, yet onboarding, unified reconciliation, and merchant analytics remain largely siloed.

The outcome is consistent across markets:

Banks fund the ecosystem.

Fintechs own the relationships, the data, and the transaction growth.

The Hidden Cost of Staying Passive

When banks do not operate their own merchant payment platforms, they quietly lose:

- Transaction fee income and float

- CASA growth tied to merchant settlement balances

- Visibility into SME, government, and public-sector payment flows

- Strategic relevance in the digital commerce value chain

This gap is widening as GCC governments accelerate:

- Cashless economy programs

- Real-time payments infrastructure

- Digitised public collections (education, utilities, licensing, municipalities)

Banks that remain passive risk becoming settlement utilities, while others control merchant ecosystems.

The Shift: From Sponsor to Operator

Leading banks across the region are now rethinking their role, not as payment sponsors, but as merchant ecosystem operators.

This shift mirrors what happened earlier in markets like ASEAN, where banks that owned merchant platforms retained:

- Merchant improved relationship with Banks

- Transaction growth

- Data-driven cross-sell opportunities

This is where Finforz Technologies positions itself differently.

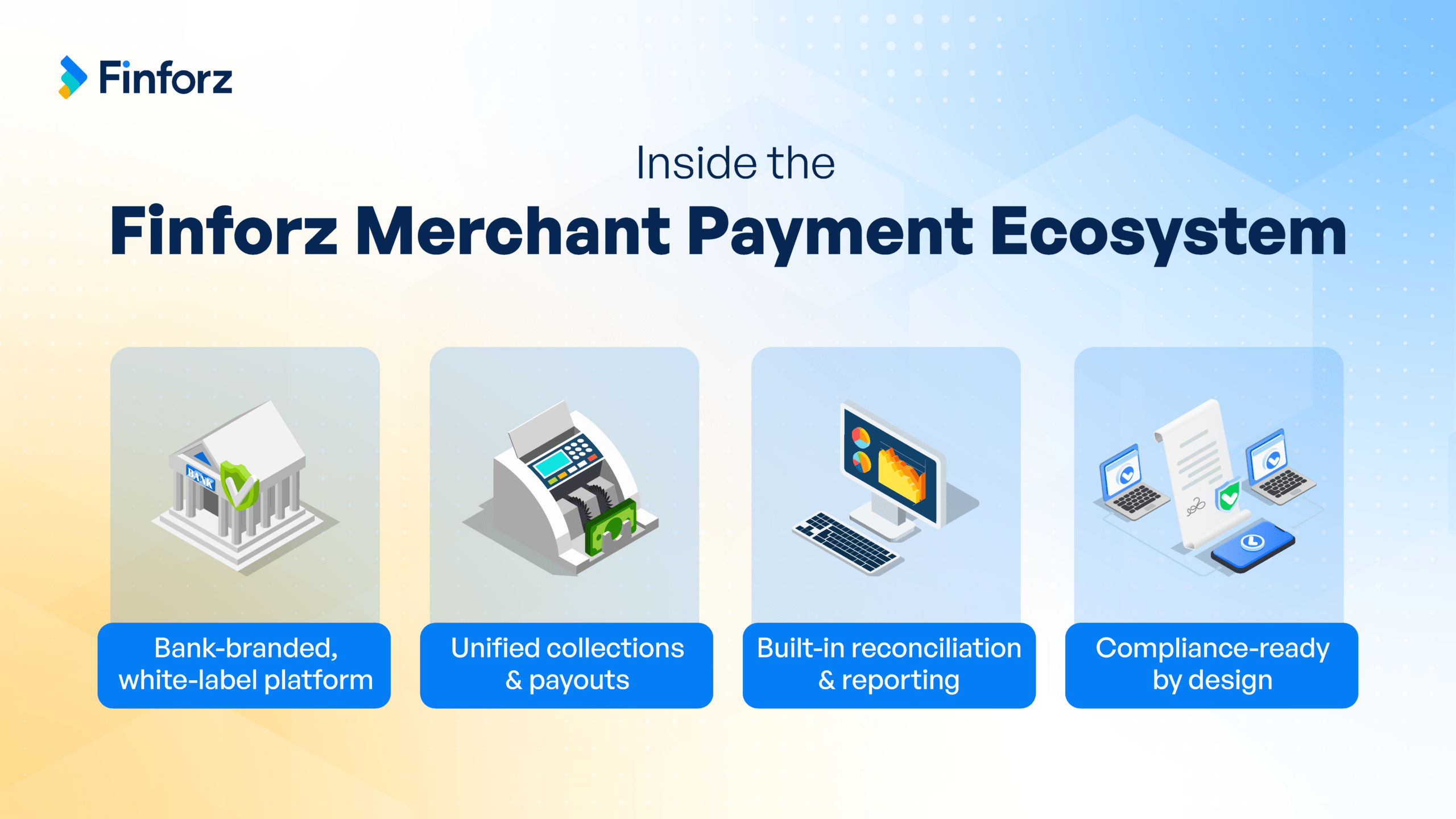

The Finforz Merchant Payment Ecosystem

Finforz enables banks and governments to launch a white-label, bank-branded merchant payments platform, purpose-built for regulated environments.

The ecosystem covers:

- Merchant onboarding & e-KYC

- Unified collections (QR, payment links, checkout, bank transfers)

- Payouts, reconciliation, and dispute management

- Analytics, monitoring, and compliance reporting

Crucially, it is delivered as a bank-owned platform, not a third-party overlay. . It enables reconciliation, and reporting processes ensuring full automation, transparency, and control while maintaining compliance, regulatory, and governance standards.

With an AI-assisted architecture, Finforz enables 20–30% of configuration and customization to be completed rapidly, significantly reducing implementation timelines, while remaining aligned with:

- Central bank frameworks

- ISO 20022 migration

- Data residency and security mandates

Why This Matters Now

In markets like Oman and Saudi Arabia:

- Digital payments are already mainstream

- Regulatory frameworks are stable and enabling

- SMEs, government entities, and semi-government institutions are ready—but underserved

Banks that act now can transition from invisible infrastructure to visible ecosystem leaders, owning merchant relationships, data intelligence, and transaction growth.

The merchant economy is growing with or without banks.

The real question is no longer “should banks participate?”

It is:

Who owns the merchant payments layer in the GCC?

Finforz Technologies partners with commercial and Islamic banks across India and the GCC to deploy white-label, compliance-ready merchant payment ecosystems designed for scale, visibility, and regulatory confidence.

Sources Referenced (publicly available)

- Saudi Central Bank (SAMA) – Vision 2030 digital payments metrics

- Central Bank of Oman (CBO) – National Payment Systems & OmanNet initiatives

- UAE Central Bank (CBUAE) & industry wallet adoption studies