Navigating the 2025 ISO 20022 Deadlines: How DataFuze Simplifies Migration and Reconciliation

ISO 20022 is an open global standard for financial information providing consistent and structured data that supports every type of financial business transaction. By offering enhanced payment data, ISO 20022 drives greater transparency, automation, and reconciliation across global banking networks.

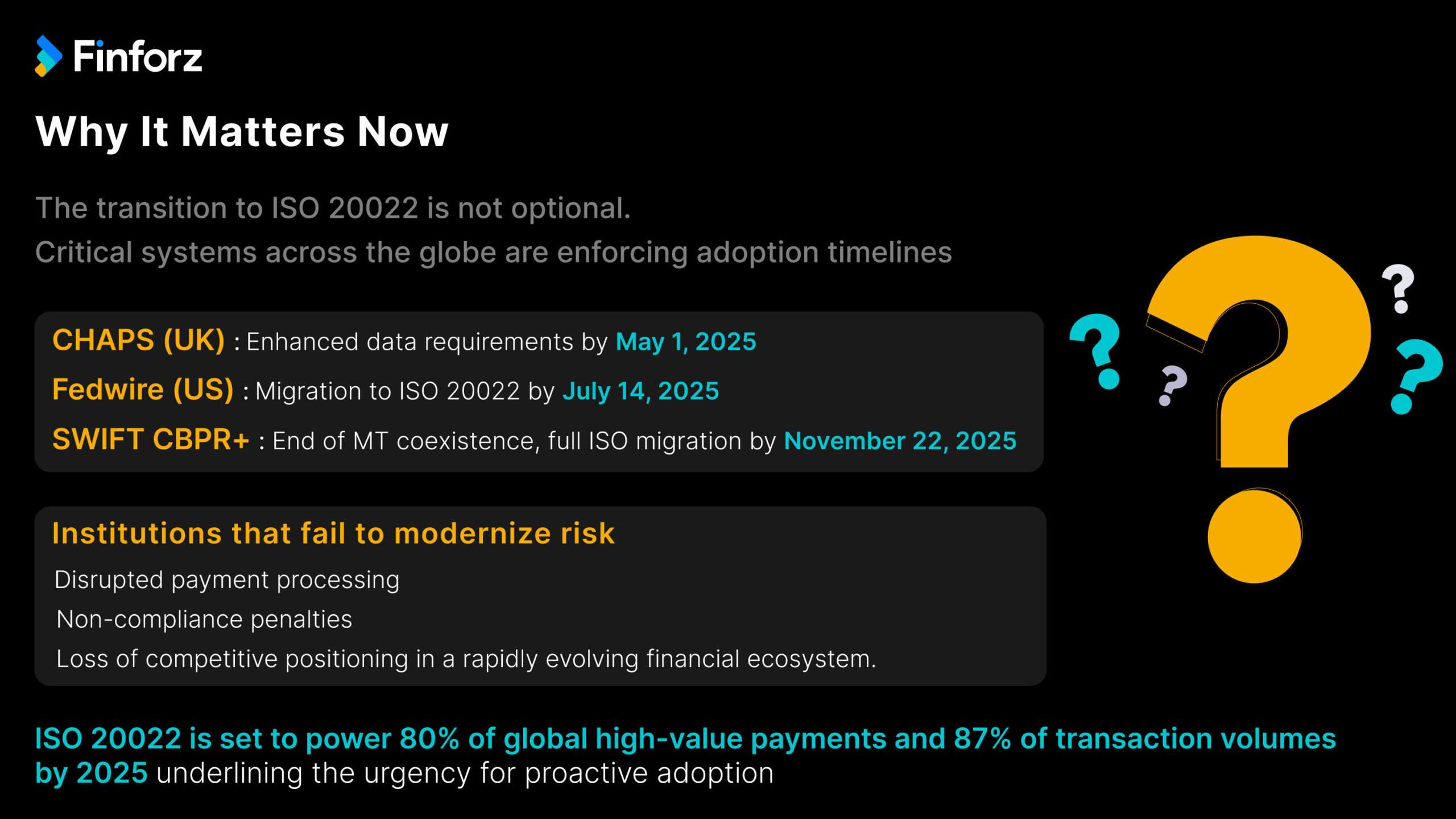

With major systems like CHAPS, Fedwire, and SWIFT CBPR+ mandating ISO 20022 adoption by 2025, financial institutions must urgently upgrade their legacy infrastructures to remain compliant and competitive.

DataFuze by Finforz Technologies is built to address this critical need, enabling seamless ISO 20022 conversion from legacy formats and delivering advanced reconciliation capabilities that leverage enriched data fields for higher accuracy, faster processing, and improved compliance.

Understanding ISO 20022 and Its Impact

ISO 20022 is more than a technical upgrade-it represents a fundamental shift in how financial information is transmitted, processed, and utilized globally. Unlike traditional message formats such as SWIFT MT, ISO 20022 delivers richer, structured, and standardized data, making financial transactions more transparent, accurate, and machine-readable.

According to SWIFT’s 2024 ISO Progress Report:

Key Advantages of ISO 20022:

How DataFuze Empowers the Transition

While ISO 20022 offers many benefits, the transition itself is complex. Legacy systems are often incompatible, manual mapping is error-prone, and enriched data requires sophisticated validation and reconciliation.

DataFuze solves these challenges by offering:

Multi-format Data Conversion Effortlessly transforms legacy formats (MT, CSV, XML, JSON, PDFs) into ISO 20022-compliant structures, eliminating manual work.