Payroll Compliance in the BaaS Era: How SBC Automates Statutory Filings with Precision

Banking-as-a-Service (BaaS) is changing the way businesses handle financial services, making it easier to offer banking features like payments, lending, and payroll directly within their platforms.Payroll-as-a-Service, in particular, is gaining momentum, allowing businesses to automate salary payments, tax deductions, and benefits processing.

However, keeping up with payroll compliance is a growing challenge. With different tax laws,labor regulations, and reporting requirements across regions, even small errors can lead to penalties and financial losses. To tackle this, banks need smarter solutions that ensure accuracy and compliance without manual effort. This is where Finforz’s Statutory Body Consolidator (SBC) helps, simplifying payroll compliance so banks can focus on seamless payroll operations.

The BaaS Boom and Payroll-as-a-Service

The BaaS market is projected to grow from $12.2 billion in 2023 to $60 billion by 2033 at a 17% CAGR driving the rise of Payroll–as–a–Service. While businesses benefit from automated payroll processing, navigating complex tax regulations and compliance requirements remains a challenge.

To overcome these hurdles, businesses are turning to intelligent automation. Solutions like Finforz’s Statutory Body Consolidator (SBC) Regulatory Systems streamline tax filings, statutory deductions, and compliance reporting-ensuring accuracy, efficiency, and regulatory adherence without manual effort.

Hidden Compliance Risks in BaaS Payroll

As BaaS transforms payroll infrastructure, several compliance risks emerge for banks. Without automation, businesses struggle with:

Payroll Tax Reporting Errors

- Incorrect tax calculations, late filings, and outdated tax law updates.

- The IRS imposes penalties of 2% to 15% for delayed payroll tax deposits.

Real-Time Payment Reconciliation Challenges

- Batch processing delays can lead to salary disbursement failures and compliance violations.

- Missing real–time reconciliation increases the risk of incorrect fund transfers.

Cross-Border Payroll Compliance Issues

Different regulatory taxes, benefits structures, and currency fluctuations create compliance challenges for global payroll operations.

- Africa presents fragmented payroll systems and limited cross–border payment infrastructure, leading to delays and inaccuracies in multi–country payroll processing.

- GCC countries like UAE and Saudi Arabia enforce strict Wage Protection System (WPS) compliance, where delays or errors in salary transfers can result in heavy fines and suspension of business licenses.

- India has frequent statutory updates—especially around EPF, ESI, and income tax slabs — making real–time payroll system updates critical to avoid non–compliance penalties.

- Malaysia mandates monthly PCB (Potongan Cukai Bulanan) tax deductions, where miscalculations or late filings can attract audits and stiff penalties from the Inland Revenue Board (LHDN).

Payroll Fraud & Security Risks

- Payroll systems are prime targets for fraud, including:

Ghost employees – Fake employees receiving salaries.

Unauthorized payroll access – Risking data breaches.

Cyber threats – Payroll data breaches can lead to financial and legal consequences. - The Association of Certified Fraud Examiners (ACFE) identifies payroll fraud as a major business risk.

Ensuring Real-Time, Automated Compliance

Here’s how:

Finforz’s Statutory Body Consolidator (SBC) transforms payroll compliance with AI–powered automation, eliminating errors and ensuring seamless regulatory adherence.

Secure Payment Processing – Automates payroll disbursements and settlements to statutory bodies with encrypted transactions.

Comprehensive Dashboard & Reporting – Provides real–time compliance insights, audit trails, and performance tracking.

Multi-Statutory Body Support – Ensures seamless compliance across multiple regulatory bodies, making cross–border payroll effortless.

Proactive Issue Detection via Instant Notifications – Leverages instant notifications via Whatsapp and Mail to immediately alert stakeholders about potential compliance deviations or discrepancies, enabling swift corrective action.

Why Businesses Need SBC?

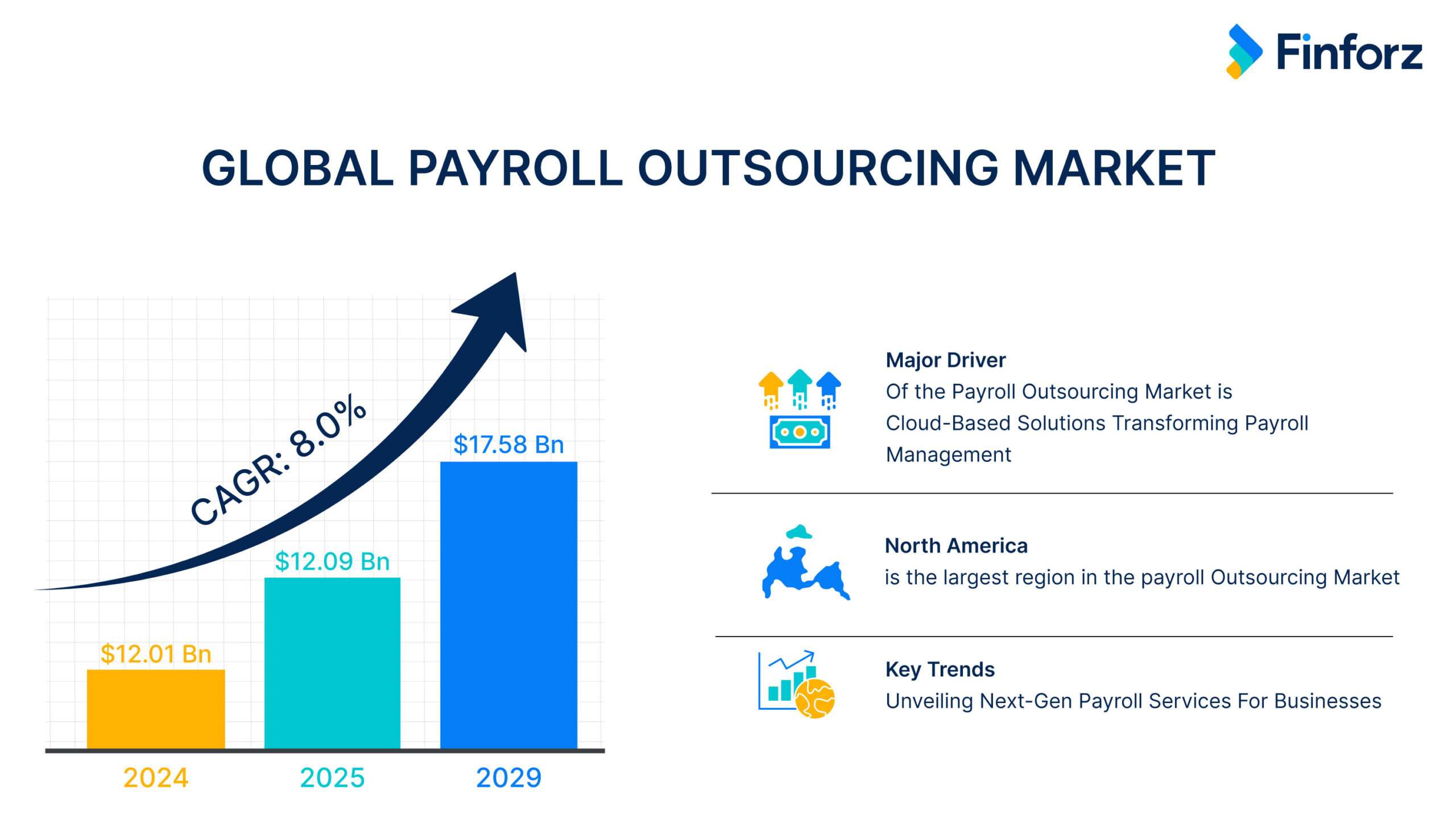

- The global payroll outsourcing market is projected to reach $19.5 billion by 2030, growing at 7.2% CAGR, indicating the rising demand for automation in compliance.

- Businesses lose an average of $845 per employee annually due to payroll errors. Automating compliance can save thousands on penalties and operational costs.

- Over 70% of businesses face payroll compliance issues—SBC ensures businesses stay ahead of evolving regulations without manual intervention.

With SBC, businesses can eliminate compliance risks, prevent payroll errors, and streamline multi–country payroll operations—all in real–time.