Open Banking Bonanza: Secure Your Cloud Before Hackers Do

Imagine a fitness app hijacking your bank account! Shocking, right? Open Banking unlocks a world of financial tools, but it also creates new security risks.

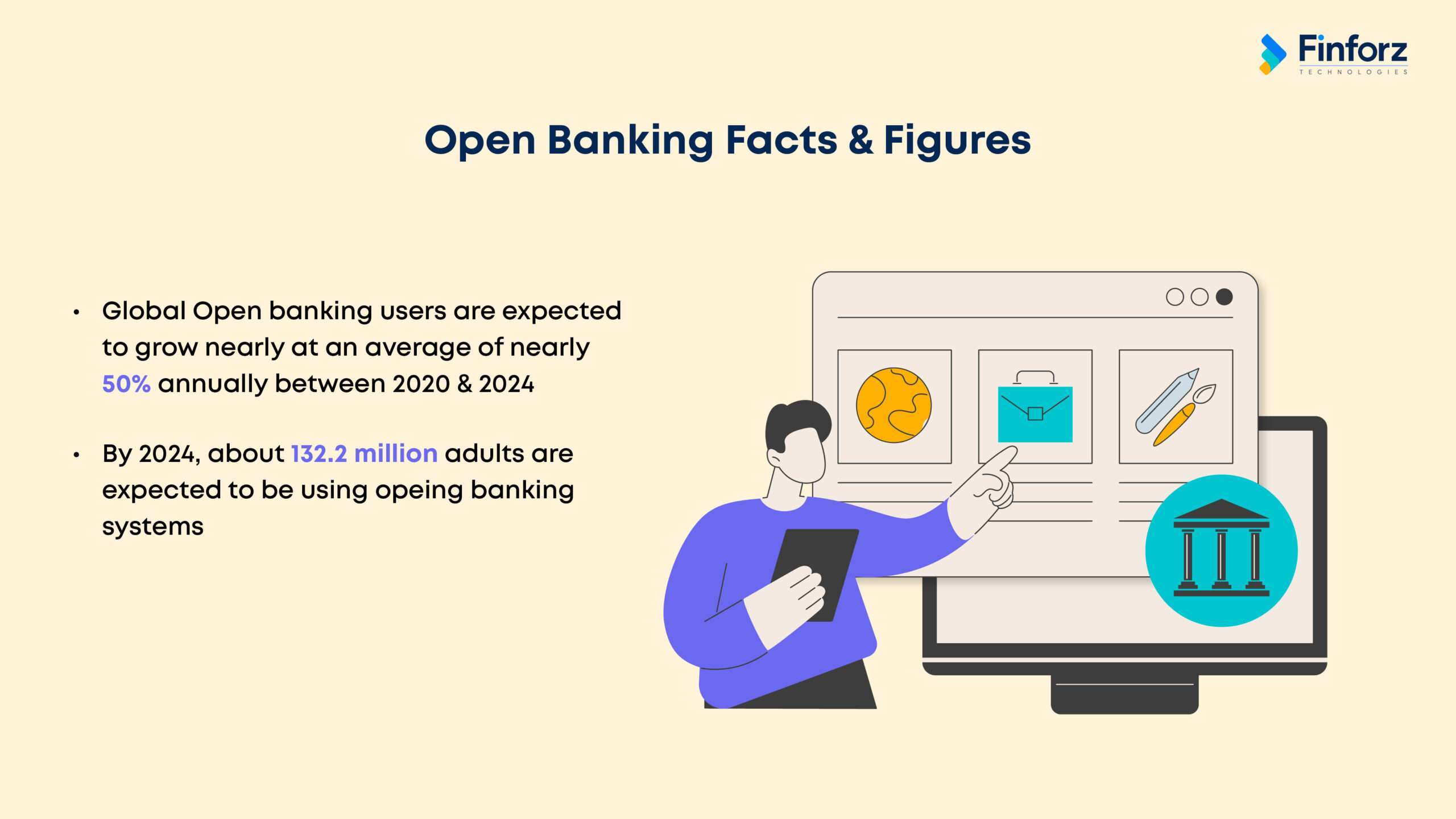

Did you know the number of banks using Open Banking APIs skyrocketed from 795 million in 2021 to over 1.13 billion in 2023? That’s a massive amount of sensitive financial data flowing through the cloud. Is your bank’s cloud secure enough?

Fortress or Fallout? Top Cloud Security Threats in Open Banking

Cybersecurity threats are like shape-shifting villains. Open Banking introduces new one’s banks need to combat:

API Ambush: Open Banking APIs are gateways to your financial data. Hackers exploit weak APIs to steal sensitive information.

Account Takeover: Malicious actors might manipulate Open Banking integrations to hijack your accounts. They could impersonate legit apps or trick users into granting unauthorized access.

Insider Intrigue: Even the most secure systems are vulnerable from within. Employees with access to Open Banking data pose a risk, especially if targeted by social engineering attacks

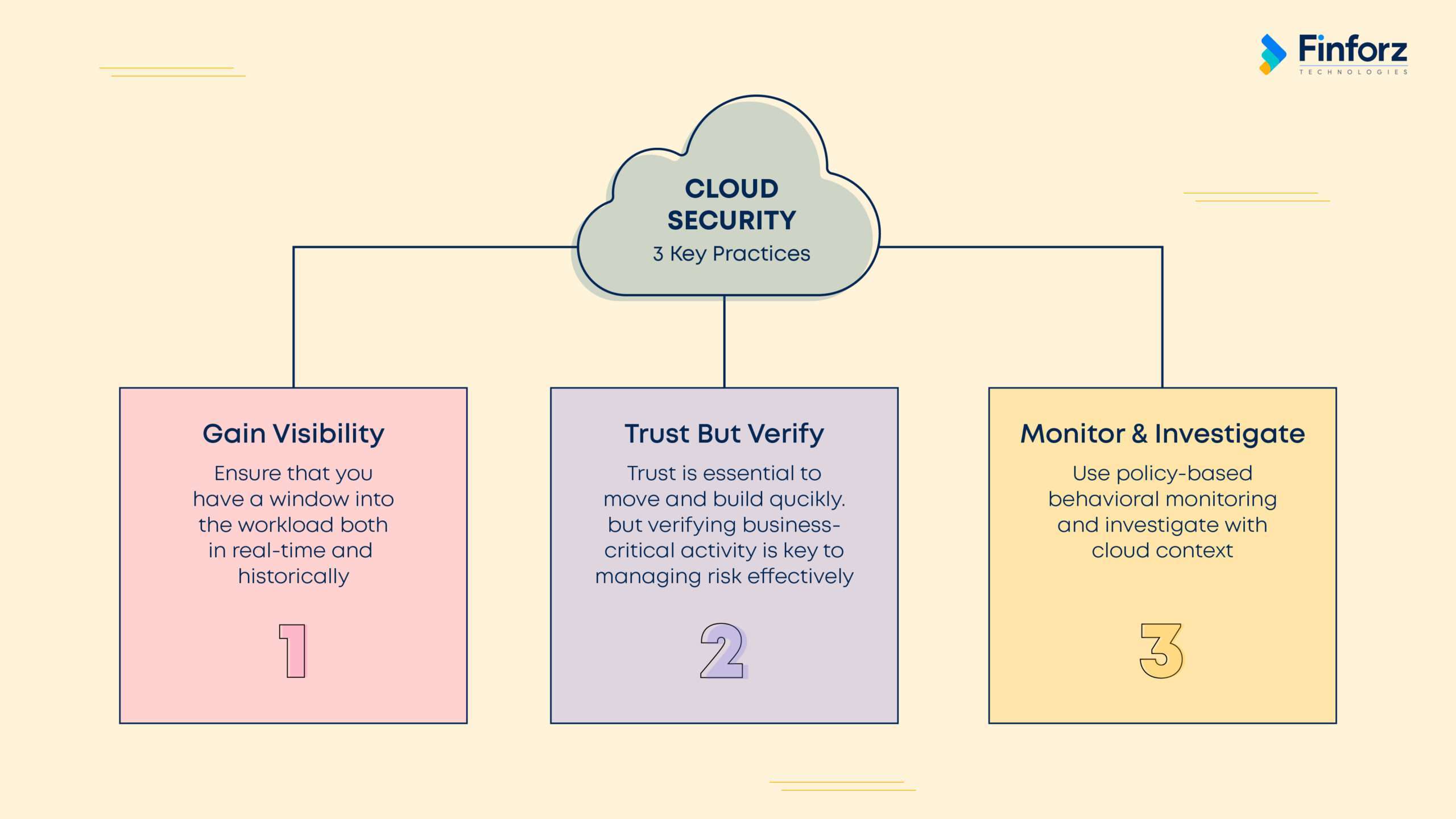

Building Your Digital Fort Knox: Essential Cloud Security Practices

Open Banking offers immense potential, but it demands a watertight cloud security strategy. Here’s your security shield:

Multi-Factor Marvel: Think of Multi-Factor Authentication (MFA) as a two-step verification for your data vault. It adds an extra layer of security beyond usernames and passwords, significantly reducing unauthorized access.

Encryption Enforcer: Imagine your data guarded by an unbreakable code, both at rest (stored) and in transit (being transferred). Encryption scrambles sensitive data using complex algorithms, making it useless without the decryption key.

Security Sentinels on Duty: Continuous security monitoring is essential. Advanced tools detect and respond to threats in real-time, preventing significant damage.

Regular Security Audits: Don’t wait for a security breach! Regular security audits identify vulnerabilities in your cloud environment so you can address them proactively.

IAM: Who Gets What, When, and Where: Identity and Access Management (IAM) dictates who has access to what data and resources within your cloud. Strong IAM protocols ensure only authorized users can access sensitive information.

Employee Security Awareness: Even the best security can be thwarted by human error. Equipping your employees with security awareness training empowers them to identify and report suspicious activity, becoming a vital line of defense.

Finforz Technologies: Your Secure Cloud Migration Partner for Open Banking

Transitioning to the cloud for Open Banking doesn’t have to be a security gamble. Finforz empowers you to navigate the Open Banking landscape with confidence:

DataFuze: Your Data Transformation Bodyguard: Our powerful data transformation system, DataFuze, plays a crucial role in safeguarding your data during migration. DataFuze utilizes robust encryption methods like PGP/GPG to protect your information at rest and in transit. Additionally, real-time monitoring capabilities provide constant vigilance for immediate threat detection and response.

Seamless Application Reengineering: DataFuze seamlessly transforms your legacy applications into cloud-ready formats, ensuring compatibility and optimized performance within your new cloud environment. This minimizes disruption to your operations and reduces the risk of security vulnerabilities during migration.

Cloud Security Gurus: Our team of cloud security specialists will work closely with you to assess your current security posture, identify potential risks, and implement a customized security strategy for your Open Banking journey.

How We Make It Happen:

Cloud Migration Strategy and Planning

Security Assessment and Implementation

Ongoing Security Monitoring and Management

Employee Security Awareness Training

Embrace the Future of Finance with Confidence

By prioritizing cloud security and partnering with Finforz Technologies, banks can unlock the transformative power of Open Banking. Our secure cloud migration services and DataFuze’s data transformation capabilities will ensure the smooth and secure flow of your financial data within the Open Banking ecosystem, fostering trust with your customers and regulatory bodies.